New data shows that plant-based alternatives are going mainstream as US retail sales reach up to $7 billion dollars in 2020.

Plant-based food retail sales in the U.S. grew double-digits to reach US$7 billion in 2020, outpacing sales of its animal counterparts for the third year in a row, according to new data. The statistics, released by the Plant Based Foods Association (PBFA) and the Good Food Institute (GFI), also showed that much of the increase was driven by surging demand from mainstream consumers, with nearly 6 in 10 households now swapping out animal-based products for plant-based alternatives.

New SPINS data published on Tuesday (April 6) by the PBFA and GFI shows that total U.S. retail sales of plant-based meat, dairy and egg alternatives grew 27{85424e366b324f7465dc80d56c21055464082cc00b76c51558805a981c8fcd63} over 2020 to top US$7 billion in market value. The sales increase, which was consistent across the entire country, represents almost twice the growth recorded in the overall U.S. retail food market, marking the third consecutive year the plant-based category has outperformed conventional animal products.

“The data tells us unequivocally that we are experiencing a fundamental shift as an ever-growing number of consumers are choosing foods that taste good and boost their health by incorporating plant-based foods into their diet.”

With coronavirus social distancing restrictions and closures giving all retail channels a boost, the plant-based category in particular benefited from the parallel pandemic-driven rise in awareness of nutrition, food safety and supply chain vulnerabilities.

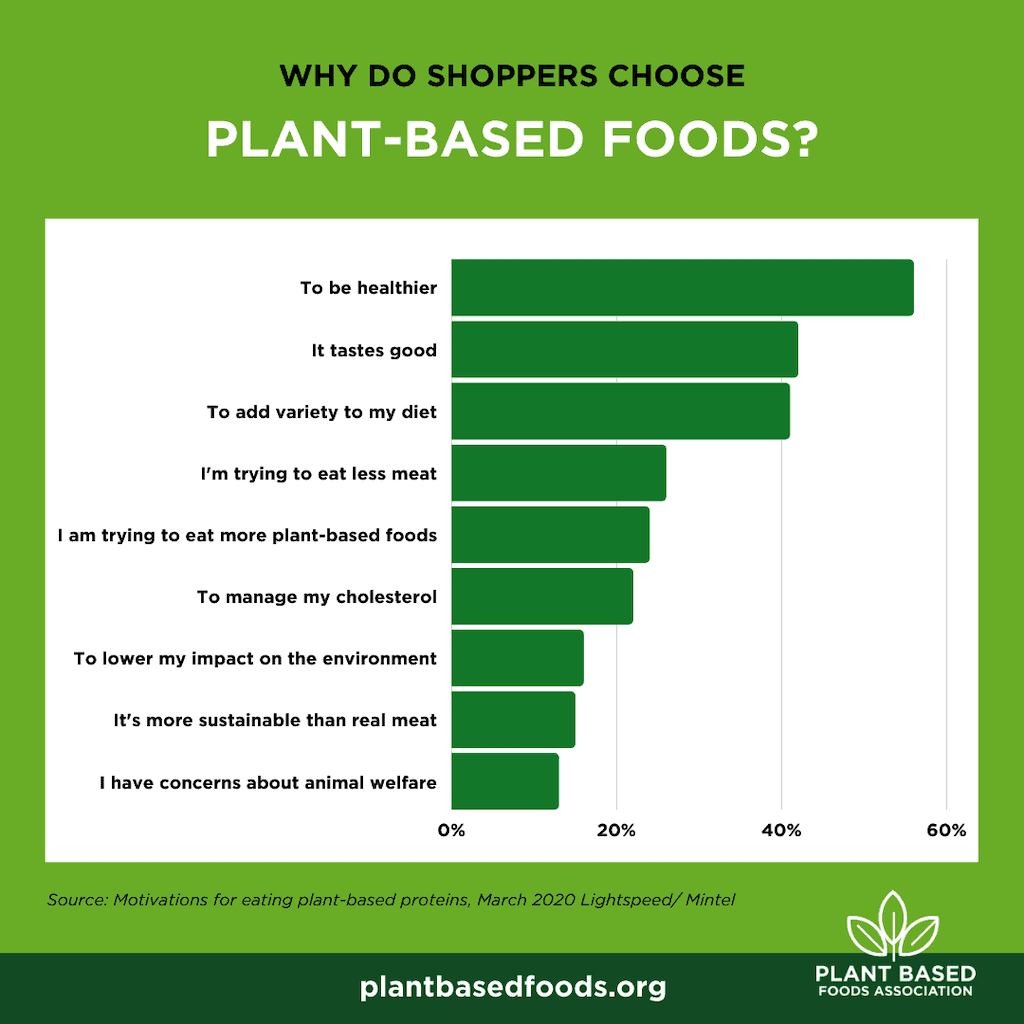

The top cited reasons for choosing plant-based foods were health, taste and dietary variety, while environmental and ethical reasons ranked lower for U.S. shoppers, though these drivers were more prominent with younger demographics. By contrast, a Veganuary 2021 global poll found sustainability-driven concerns and animal welfare tended to be more important motivators for people to make plant-based dietary changes.

Mainstream consumers began purchasing more plant-based products, with the latest data showing that a majority of all U.S. households – 57{85424e366b324f7465dc80d56c21055464082cc00b76c51558805a981c8fcd63} – are now actively choosing these alternatives to replace animal-based items, up 5{85424e366b324f7465dc80d56c21055464082cc00b76c51558805a981c8fcd63} from the year before. The data, based on a consumer panel of roughly 100,000 households, was custom refined by SPINS to reflect sales that directly displaced purchases from the animal-based category.

“The data tells us unequivocally that we are experiencing a fundamental shift as an ever-growing number of consumers are choosing foods that taste good and boost their health by incorporating plant-based foods into their diet,” remarked Julie Emmett, senior director of retail partnerships at PBFA.

By segment, plant-based meat sales grew 45{85424e366b324f7465dc80d56c21055464082cc00b76c51558805a981c8fcd63} to hit US$1.4 billion in 2020, a marked increase from US$962 million recorded in 2019. Nearly a fifth of all households now purchase plant-based meat alternatives, with as many as 63{85424e366b324f7465dc80d56c21055464082cc00b76c51558805a981c8fcd63} new shoppers continuing to do so and categorised as “high-repeat” customers.

It aligns with previous survey findings in the U.S. suggesting that as many as 92{85424e366b324f7465dc80d56c21055464082cc00b76c51558805a981c8fcd63} of first-time buyers of plant-based meat plan on doing so in the long-term, even after the pandemic ends.

“2020 was a breakout year for plant-based foods across the store. The incredible growth we saw in plant-based foods overall, particularly plant-based meat, surpassed our expectations and is a clear sign of where consumer appetites are heading,” said Kyle Gaan, GFI research analyst.

The largest plant-based category, plant-based milk, now represents for 35{85424e366b324f7465dc80d56c21055464082cc00b76c51558805a981c8fcd63} of the market with a US$2.5 billion market value after recording 20{85424e366b324f7465dc80d56c21055464082cc00b76c51558805a981c8fcd63} growth in dollar sales over 2020. Leading the category is almond milk, with oat milk following closely behind after a tripling in sales over the year and an astonishing 25-fold increase since 2018. A strong indication of the incredible mainstreaming of dairy-free alternatives, almost 40{85424e366b324f7465dc80d56c21055464082cc00b76c51558805a981c8fcd63} of all U.S. households now stock vegan milk in their fridge as opposed to having the traditional dairy-based version.

Other plant-based dairy products, which include dairy-free yogurt, butter and cheese, had also grown significantly and are together reaching around US$2 billion. These smaller but fast-growing segments strongly outperformed its traditional animal-based counterparts, with plant-based yogurt, for instance, growing at 7-times the rate of dairy yogurt.

Plant-based eggs, on the other hand, recorded triple-digit growth in 2020, with the category as a whole growing 700{85424e366b324f7465dc80d56c21055464082cc00b76c51558805a981c8fcd63} since 2018 to outpace conventional eggs by 100-fold.

Commenting on the latest plant-based data, Dawn Valandingham, head of retail at SPINS, said: “The plant-based category has evolved to the point that retailers can’t limit who they consider the plant-based shopper. They should now assume everyone is a potential plant-based buyer.”

Valandingham added that the research predicts that plant-based food consumption trends will continue on in the coming months and years. “Between the innovation in plant-based products and the gradual return to less restrictive shopping measures, 2021 offers many opportunities for retailers to appeal to more customers and expand their plant-based offerings.”

Original source: https://www.greenqueen.com