According to a new report sustainable, vegan protein alternatives are likely to overtake meat sales as they become more affordable and accessible.

As alternative proteins scale up and reduce costs, they “promise substantial disruption” to the conventional animal meat market, says a new report. The analysts also pointed to changing regulations and fast-growing consumer adoption as key factors propelling the alternative protein industry, and advised conventional protein producers to “consider a more diverse portfolio” as pressure piles on to reap returns.

Businesses across the food industry are going to need to align themselves with the alternative protein trend to “stay ahead in the food value chain space”, according to a new report from multinational consultancy Ernst & Young (EY).

Outlining the positive trajectory that alternative proteins are heading in, from the industry bagging more than US$16 billion in total investments in the past decade to the number of startups in the sector exceeding 1,000, researchers believe that even conventional meat players will come under huge pressures to participate and capitalise on the trend.

Moreover, cost and quality are both “improving rapidly”, which will further accelerate mass adoption of alternative proteins. EY analysts believe that the cost of alternative protein production will reach price parity with conventional meat by the mid-2020s, and even undercut meat prices by 2030.

The prediction is in line with a recent Good Food Institute (GFI) report, which detailed the trajectory of cell-based proteins reaching price parity by the end of this decade, while also slashing 92{85424e366b324f7465dc80d56c21055464082cc00b76c51558805a981c8fcd63} of greenhouse gas emissions compared to traditional animal farming.

“The alternative protein industry is dynamic. Advancing technologies, decreasing cost curves, changing regulations and increasing consumer adoption will lead to substantial gains in market share for alternative protein over the coming decade,” wrote Rob Dongoski, agribusiness leader at EY.

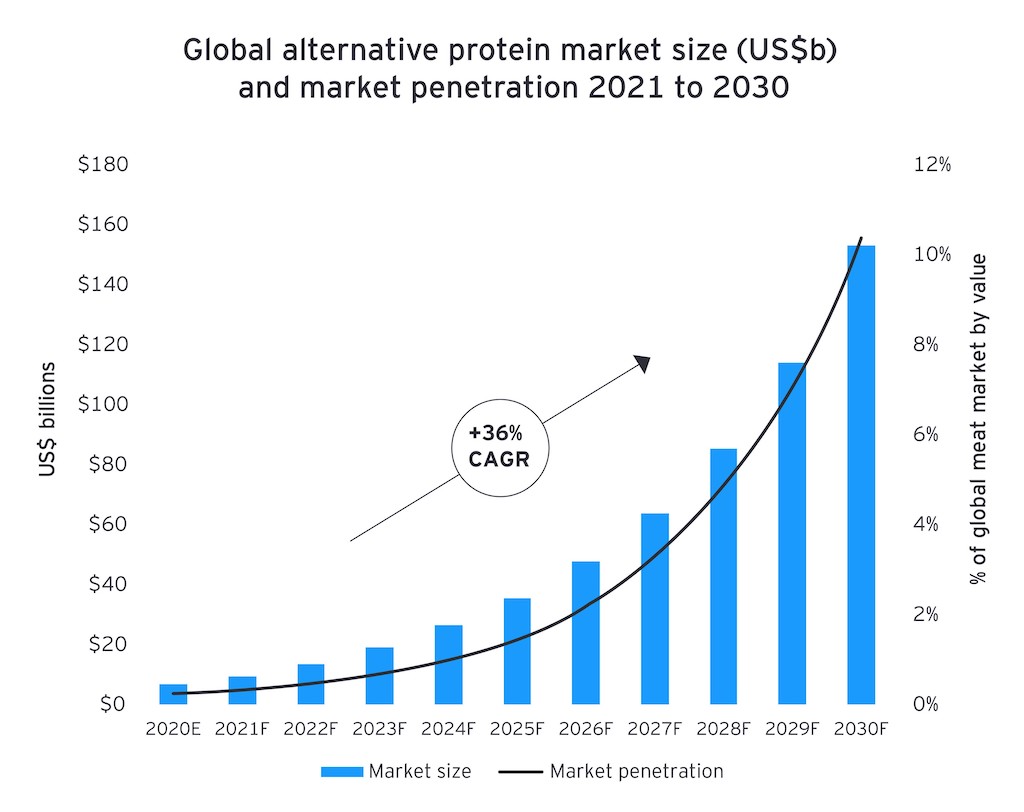

At its current rate, EY researchers predict that the total alternative protein market size will grow double-digits annually and reach between US$77 billion and US$153 billion by the end of the decade – up from its current estimated size of US$5 billion and US$10 billion in 2021.

This growth far outpaces the single-digit rates of the conventional protein market, whose prices are sensitive to supply chain vulnerabilities and are likely to rise over time to turn more shoppers towards alternative options on the market. “Increasing affordability for end consumers will be a critical driver of adoption, particularly in middle-income countries,” said Dongoski.

In addition to lowering costs over time, EY researchers say that alternative protein producers will shorten their ingredient lists and develop cleaner labels to appeal to even more consumers, while also better imitating the sensory profile and experience of conventional meat products.

Innovation in product quality will not only come from the plant-based sector, where products are already on the market, but also from the cell-based protein and fermentation protein pillars.

“Cultivated products promise substantial disruption to the conventional protein industry, particularly as production costs decline.”

The analysts cited the approval of Eat Just’s cultured chicken to be sold in Singapore as a major accelerator for the wider adoption and commercialisation of cell-based proteins, describing the event as a “milestone” that could have “large ripple effects” across the region and globally in constructing the regulatory frameworks for these products.

“Cultivated products promise substantial disruption to the conventional protein industry, particularly as production costs decline,” wrote Dongoski. “Protein via fermentation could [also] be substantially less expensive than conventional proteins between 2030 and 2035.”

The EY report advises food businesses, from meatpackers to animal feed producers, must quickly pivot and change their strategies to incorporate alternative proteins if they are to stay ahead of the curve now, and in the future.

A number of large food conglomerates and retailers are already making these moves, including the world’s biggest meat processor JBS, who recently acquired Dutch plant-based meat maker Vivera to enlarge its alternative protein portfolio, while American group ADM opened up a “plant-based innovation lab” in Singapore to ramp up their meatless offerings.

Even seafood giant Thai Union has made its intentions clear to tap into the lucrative plant-based market with a new vegan shrimp product slated to land on shelves this year.

“All food value chain players can consider their product strategy and participation to capitalize on the alternative protein trends,” Dongoski explained. “Conventional producers can begin considering a more diversified portfolio…new and potentially more profitable opportunities are emerging.”

Original source: https://www.greenqueen.com